formula for calculating work in progress inventory

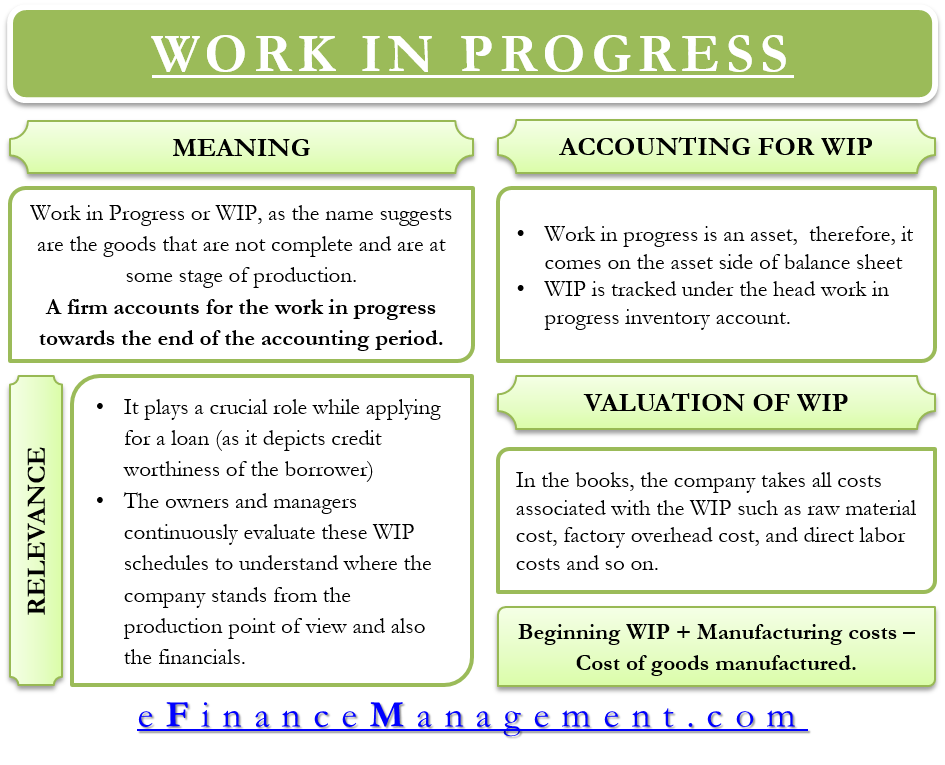

For the exact number of work in process inventory you need to calculate it manually. For accounting purposes work in process is an asset and therefore is aggregated into the inventory line item on the balance sheet.

How To Calculate Finished Goods Inventory

Has a beginning work in process inventory for the quarter of 10000.

. Work in process inventory examples. For example you have run out of materials to create a certain amount of products. The formula for this is as follows.

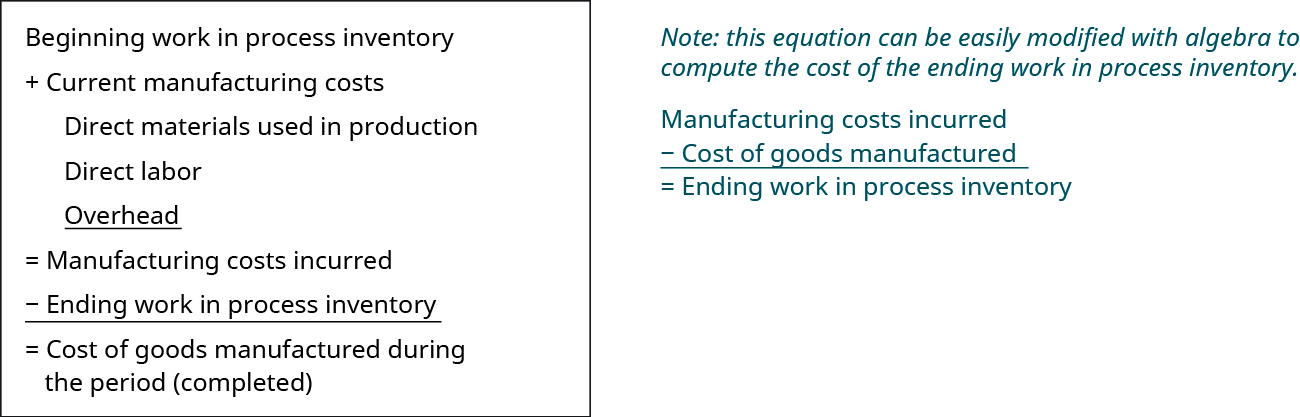

Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs- Ending WIP Inventory. What is the work-in-process formula. Once youre able to determine your beginning WIP inventory and you calculate your manufacturing costs as well as your cost of manufactured goods you can easily determine how much WIP inventory you have.

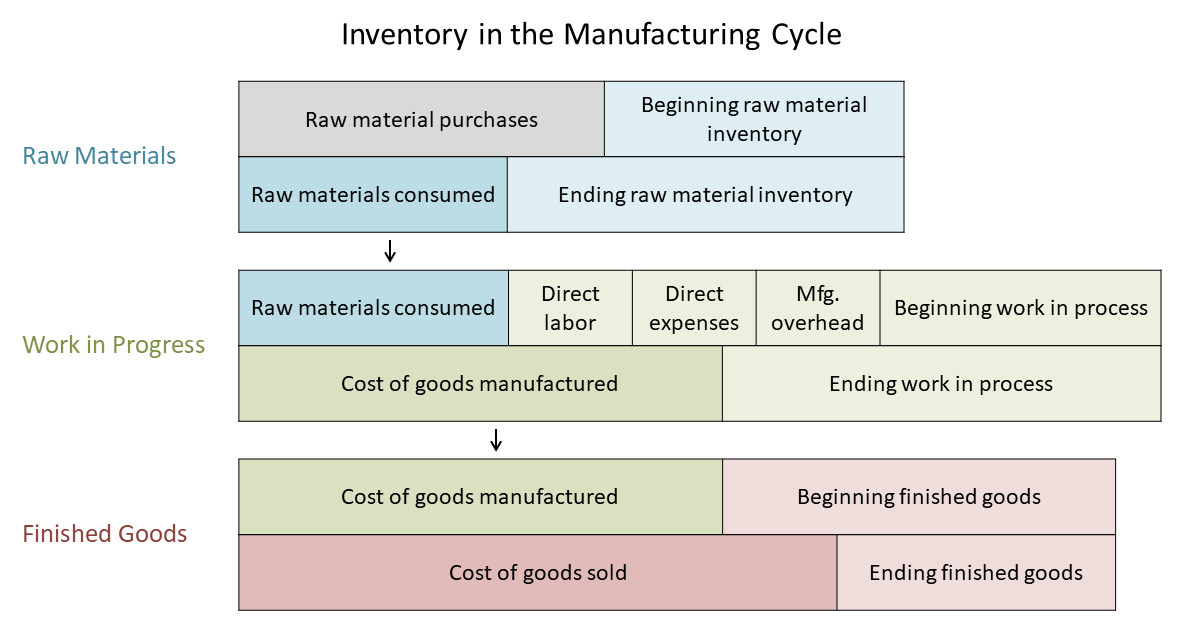

Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory Calculating WIP inventory. Understanding Works-in-Progress WIP How do you calculate work in process inventory. Inventory formula inventory calculator excel template.

The WIP figure reflects only the value of those products in some intermediate production stage. 4 Divide the total costs by equivalent units to establish a cost per equivalent unit. After the beginning WIP inventory is determined along with the manufacturing costs and the COGM its easy to calculate the amount of WIP inventory that you currently have.

8000 240000 238000 10000. Example of the Ending Work in Process Calculation. The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods.

Find the beginning work in progress WIP inventory Beginning WIP inventory Materials purchased Materials transferred to production 100000 - 92000 8000. Calculating Ending Inventory - 14 images - how to calculate ending inventory formula and steps work in progress inventory accounting in focus solved why is 2100 not correct what is the correct ending inventory formula. Beginning WIP Manufacturing costs - Cost of goods manufactured Ending work in process.

Higher sales and thus higher cost of goods sold leads to draining the inventory account. The calculation of ending work in process is. Abnormal loss- Physical units produced are multiplied by the degree of completion.

Abnormal gain- Physical units 100 complete. The last quarters ending work in process. This calculation requires that the billable total price and budget total price be correctly entered for the whole job.

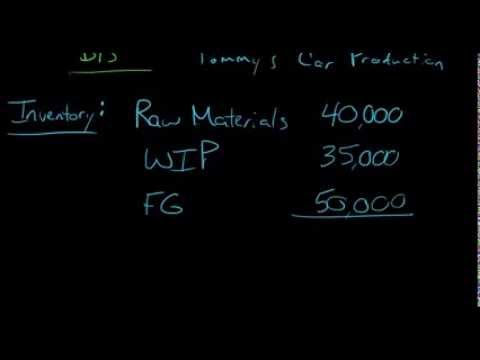

Work In-process Inventory Example. Here are a number of highest rated. Work in process is usually the smallest of the 3 most common inventory accounts.

Lets use a best coffee roaster as an example. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods. Your WIP inventory formula would look like this.

The ending WIP beginning WIP manufacturing costs - cost of goods produced. Work in process inventory 60000. Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM.

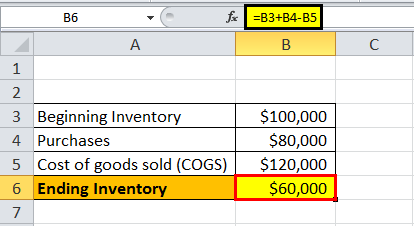

Keep in mind this value is only an estimate. Ending Inventory Beginning Balance Purchases Cost of Goods Sold. However by using this formula you can get only an estimate of the work in process inventory.

Under this method the cost of completed units is calculated by multiplying production expressed in terms of equivalent units. The conceptual explanation for this is that raw materials work-in-progress and finished goods current assets are turned into revenue. The amount of ending work in process must be derived as part of the period-end closing process and is also useful for tracking the volume of production activity.

Imagine BlueCart Coffee Co. This calculation typically includes the cost of raw materials being used a portion of the labor and a portion of the factory overhead to get a good idea of what costs have been covered thus far in production and what. Assume Company A manufactures perfume.

3 Calculate the total costs for each factor for the period. Work in process operating inventory goods in process raw materials used during the period direct labor during the period factory overhead for a period ending inventory. Another example would be one of your production equipment has broken down so your processes have come to a halt.

Work in Progress Inventory Formula Initial WIP Manufacturing Costs Cost of Goods Manufactured Costs - Cost Of Goods Manufactured Cost of Goods Manufactured Formula is value of the total inventory produced during a period and is ready for the purpose of sale. Calculating work in progress inventory. To calculate your in-process inventory the following WIP inventory formula is followed.

The formula for calculating WIP inventory is. 5 Multiply equivalent units by cost per equivalent unit to ascertain the cost of finished production and work-in-progress. This represents the value of the partially completed inventory which accounts for only a part of what the company will actually produce.

10000 300000 250000 60000. The other two being raw materials and finished goods. As a result of this you would have to freeze the production process until you have bought the materials to use.

In this case for example consider any manufactured goods as work in process. Work in progress inventory or WIP for short refers to the total cost of unfinished goods that are currently in production. The formula for calculating the WIP inventory is.

The WIP figure indicates your company has 60000 worth of inventory thats neither raw material nor finished goodsthats your work in process inventory. This means that Crown Industries has 10000 work in process inventory with them. Calculating Your Work-In-Process Inventory.

The work in process formula is expressed as. Percentage of Completion Recognized Costs Usage Total Costs Recognized Revenue Billable Total Price x Percentage of Completion Percentage of Completion Usage Total Costs Budget Total Costs Referred to as Cost Completion on. How to Calculate Ending Work In Process Inventory.

The beginning WIP inventory cost refers to the previous accounting periods asset section of the balance sheet. Let us take a company ABC which manufactures widgets. WIP is calculated as a sum of WIP inventory total direct labor costs and allocated overhead costs.

The work in process formula is.

Ending Inventory Formula Step By Step Calculation Examples

What Is A Work In Progress Wip 2020 Robinhood

What Is Work In Process Wip Inventory How To Calculate It Ware2go

3 Types Of Inventory Raw Materials Wip And Finished Goods Youtube

Wip Inventory Definition Examples Of Work In Progress Inventory

Work In Process Inventory Formula Wip Inventory Definition

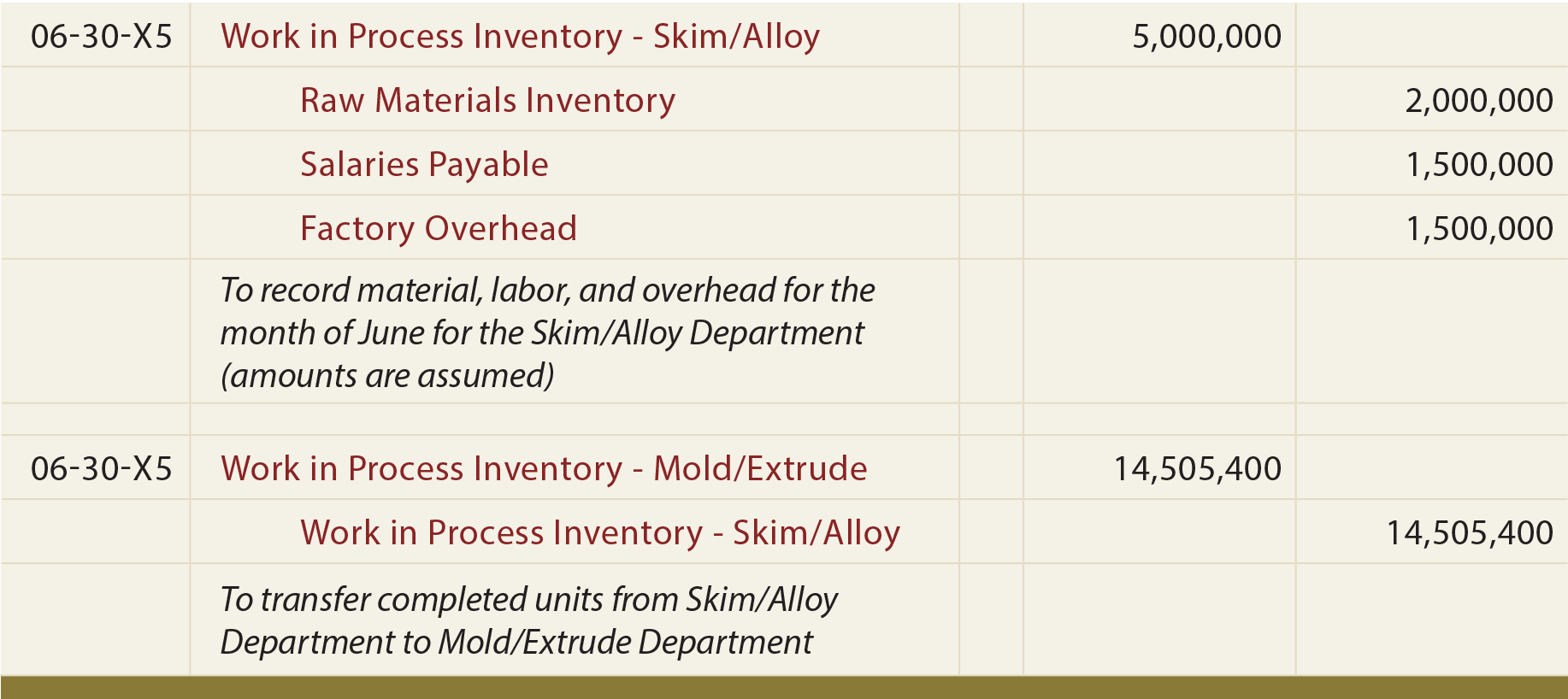

Use The Job Order Costing Method To Trace The Flow Of Product Costs Through The Inventory Accounts Principles Of Accounting Volume 2 Managerial Accounting

Ending Inventory Formula Step By Step Calculation Examples

Work In Progress Meaning Importance Accounting And More

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

Solved Calculate The Ending Work In Process Inventory Chegg Com

What Is Work In Progress Wip Finance Strategists

Cost Allocation To Completed Units And Units In Process Principlesofaccounting Com

Work In Process Wip Inventory Youtube

Solved Data Table Gallons Work In Process Inventory Chegg Com